|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

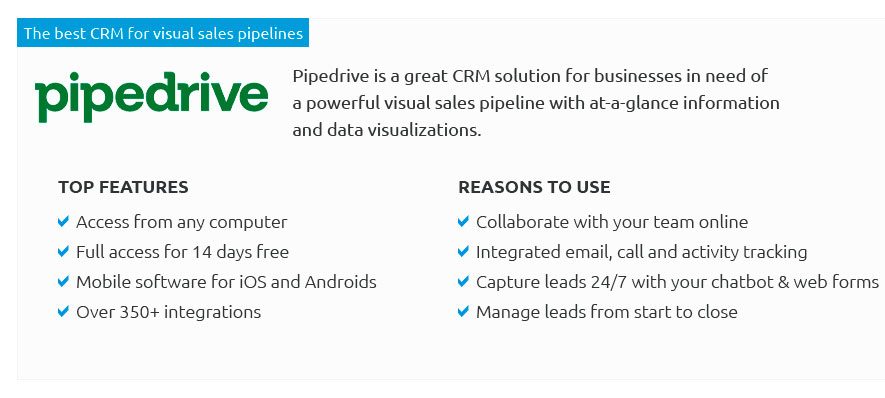

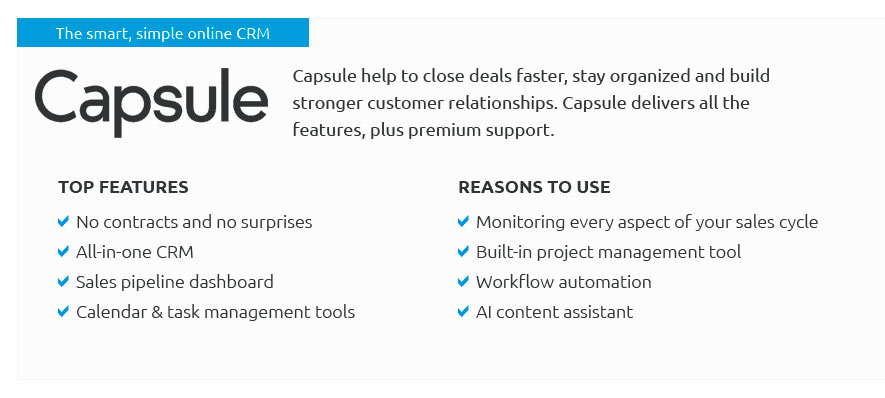

cebnzl3fj Unlock the future of financial relationship management with our cutting-edge CRM software review, where we dive deep into the best CRM platforms that are revolutionizing the world of investment banking-these are not just tools, they're game-changers that elevate your client interactions, streamline workflows, and enhance decision-making with precision; from powerful analytics to seamless integration capabilities, our expert analysis equips investment bankers with the insights needed to choose the ultimate CRM solution, empowering them to foster stronger client relationships and drive unparalleled growth in an ever-evolving market.

https://www.affinity.co/guides/investment-bankings-guide-to-choosing-the-right-crm

This guide is designed to help you explore purpose-built investment banking CRM solutions and extensions. https://www.mademarket.com/

MadeMarket's purpose-built CRM and deal management platform is the best way for investment bankers to manage their deals, opportunities, contacts, and more. Get ... https://ascendix.com/blog/investment-banking-crm/

CRM software stands as a pivotal technology for investment banking, addressing these challenges and enhancing deal management and productivity.

|